Over my 40+ years of being involved in the business of professional investment practice, I have been blessed by being in the United States. Since coming into this business as a young man, I have witnessed good and bad times, but the good experiences outnumber the challenging experiences rather dramatically.

Since the late 1970s, the U.S. economy has experienced many events. From an investment perspective, the single most important development over that period has been the systemic decline in global inflationary pressure along with the systemic decline in global interest rates. This massive decline in the global cost of capital has opened many doors, including the strong downward push in global deep poverty as defined by the World Bank. This push brought more than a billion people out of the despair of deep poverty, opening the door for throngs of people to benefit by the capitalist system.

Along with lowering capital costs, the world’s stock markets have performed very well. In the U.S., from 1981 through 2019, the S&P 500 rose by a stunning 2,536% in price.1 This seems almost surreal. One would think that corporate profits drive stock prices, and they do. But something else has been at work over this period driving stock prices higher and that has been the collapse in global inflation rates along with the strong decline in interest rates.

PROFIT GROWTH – AND?

Profit growth rates tend to drive stock prices. Most of us know and understand this fundamental behind stock price movement. We need to ask the question, “Over the long term, are profit growth rates the sole driver of stock price movement?”

Let’s look at a simple comparison between the S&P 500’s price change over a period of time as compared to the S&P 500 profit growth for the same time horizon. From 1981 through 2019, S&P 500 earnings grew by 970%, but the S&P 500 price change of 2,536% over this period dwarfed the profit growth rate.2

Between 1981 and 2019, something else was at work that was driving stock prices higher besides profit growth. Something else was driving investor preference toward the stock market, and that something was the systemic decline in both inflation and interest rates. Bond yields collapsed over the period noted, driving investor preference toward the ownership of stocks and away from bonds.

From 1981 through 2019, the yield on the 10-year U.S. Treasury note declined from 13.92% to 2.14%.3 This massive 1,000+ basis point decline in rates was so pronounced that eventually interest rates fell below inflation rates, creating negative real interest rates in the government bond markets in many countries. In some government bond markets, nominal interest rates fell below 0%; an abnormality that has proven unsustainable.

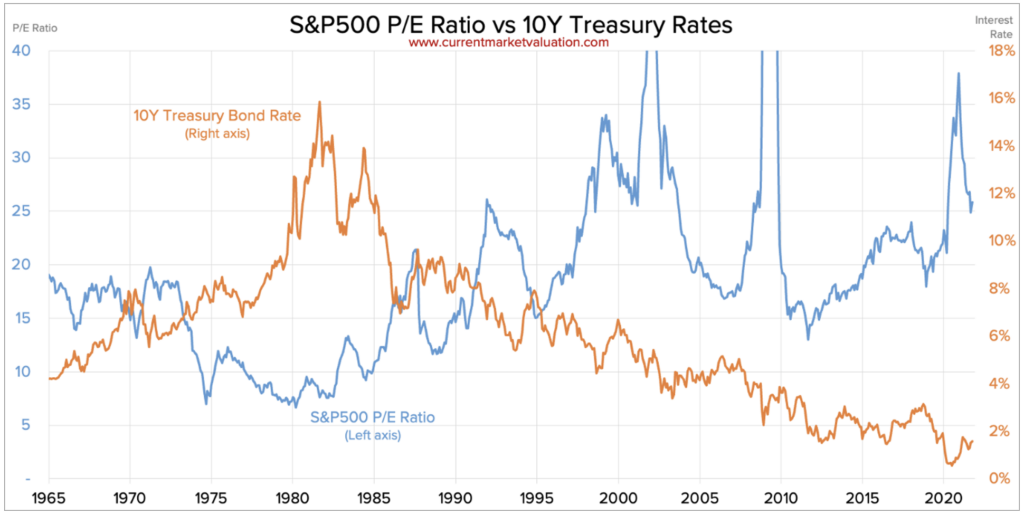

Over the period in which interest rates were falling, stock market price-to-earnings (P/E) ratios rose dramatically from 8.0x earnings in 1981 to 19.9x earnings in 2019.4 P/E ratios reflect many things, with inflation and interest rates being prime drivers of expanding or contracting P/E ratios. The chart below nicely shows the historical relationship between 10-year U.S. Treasury note yields and the S&P 500 P/E ratio.

Source: Currentmarketvaluation.com

Note the period from 1981 through 2019. People are willing to pay a higher ratio of profits per dollar invested in the stock market when interest rates and inflation are falling. This only makes sense. When bond yields are lower and provide less competition for capital allocation, investors’ preferences shift toward alternatives, with stocks being a main competitor for capital. As a sidebar item, note the period from 1965 to 1981 when bond yields were rising and the effect that had on stock market P/E ratios. P/E ratios collapsed from almost 20x to single digits as Treasury yields jumped from 4%, eventually reaching almost 16%.

It is easy to see that the stock market is a prime beneficiary of capital flows during times of declining inflation and interest rates.

ALL BOATS RISE WITH A RISING TIDE

It is also easy to understand that during times when the cost of capital is declining, and inflation pressure is declining, all companies irrespective of their business plan can and normally do benefit by this trend to one degree or the other. During times of declining interest rates, companies are afforded the opportunity to expand profit margins as their cost of capital is shrinking.

All boats rise when the tide is rising, and all tend to fall when the tide is receding. The same can be said when inflation and interest rates are declining—that most companies are afforded the opportunity to benefit by this trend. This is what was happening during the period of 1981 to 2019.

The conclusion is easily reached that investing in an index, or a passive alternative, will perform well during a time when the main driver of valuation isn’t just profit differentiation but is rather an environment where most companies will perform reasonably well.

Index investing has become popular from a rational standpoint over the last three to four decades, a period in which stock price performance has been driven upward by not only profit growth but also a period of systemic downward movements in inflation and interest rates. Investing in the stock market has worked.

THE PASSAGEWAY

I believe the world has or is entering a new, different type of fundamental environment where the fundamental drivers of ever-lower inflation and interest rates was yesterday’s story. An environment where the globalization of the world’s economy is slowing and perhaps in certain cases reversing. I have argued in previous commentaries that the main drivers over the last 30 years of low interest and inflation rates has been the massive shift of economic globalization.

That shift is now being replaced by growing nationalistic tendencies, which are being driven by political changes. China, through the leadership of President Xi, has made it clear that the pro-business and pro-free trade reforms of the 1970s are being reversed. The U.S. and many countries in Europe have concluded that China and their allies are now not just an economic threat but may indeed become a political/military threat of the future.

Global trade, or globalization of the world’s economic power (trade relative to global GDP), rose dramatically from 35% in 1983 to 61% in 2008. Since then, the ratio fell to 52% in 2020.5 The world benefited over the period of 1983 through 2008 by falling inflation pressure being brought on in an example of David Riccardo’s “Comparative Advantage” theory. His theory was put into practice, and the payoff was a major decline in global inflation and interest rates, as demonstrated earlier.

I argue that now that fundamental driver of ever-lower interest and inflation rates is changing.

MARKET OF STOCKS AND NOT A STOCK MARKET

I suggest the upward push in inflation pressure we are seeing isn’t something that will go away quickly. I do not believe that 3% to 4% inflation rates are something that will easily disappear unless accompanied by a weak overall economic environment.

The period of widespread benefit of ever-declining inflation and interest rates may be over. One of the drivers that has benefited all companies is also probably changing. Going forward, I suggest there will be a widening gap between companies that are doing well (rising profit growth rates and rising profit margins) and those that are struggling. The variance between winners and losers will widen and, with it, stock performance should be very good for some companies and not so good for others.

The glory days of owning a stock market may indeed give way to days when owning a market of stocks makes more sense and is more profitable.

The obvious question this raises is, “Which companies are going to do well and which will not?” The answer to this question is beyond the reach of this commentary, but I suggest the environment where active managers will have the opportunity—not the mandate, but the opportunity—to outperform relevant indexes will probably be enhanced compared to the last few decades when falling inflation and interest rates helped moderate the variance between corporate winners and losers.

OTHER IDEAS TO CONSIDER

Along with starting to consider the role of active equity management, I suggest the investment environment going forward will offer some interesting opportunities away from U.S large-capitalization stocks.

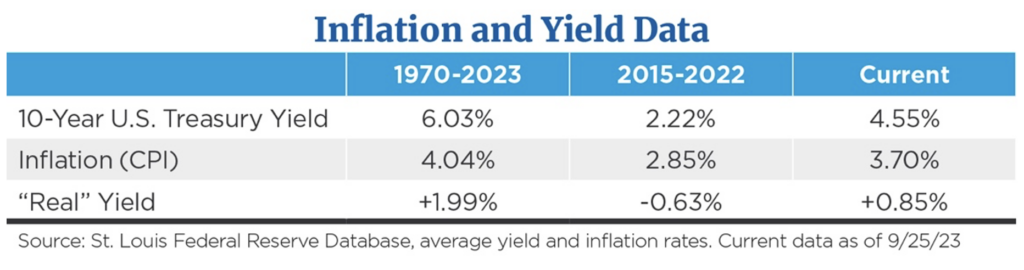

The main driver of returns in the bond market is interest rates and coupon rates to be more specific. Inflation and inflation expectations are major drivers of interest rate levels. If one expects that long-term inflation will center in the 3% to 4% range (as I do), then rates that are above that underlying inflation rate start to become attractive. Below find inflation and yield data for various periods of time.

While the current 10-year Treasury yield at 4.5% isn’t back to the long-term average “real” yield level, the yield has come quite a ways from the days when real yields were negative over the seven years ending in 2022. Given my longer-term outlook for inflation to center in the 3% to 4% range, the bond market is starting to look attractive relative to underlying inflation pressures.

LAST WORD

I believe the world has entered an economic “passageway” leaving an old room where inflation and interest rates have been very low for a very long period, driven by the strong trend of growing economic globalization. I suggest this trend is changing and with it the fundamentals that have led to the days of ever-declining inflation and interest rates moderating.

With this in mind, the fundamentals that drove capital toward the U.S. and other equity markets are changing. I suggest the variance of stock performance between future winners and losers will probably widen as the soft comfort allocated to all companies because of declines in the cost of capital will probably moderate. Equity selection, and not just index selection will matter.

Additionally, I also see a period when owning other asset classes may prove to be profitable. I place bonds, commodities and real estate in these opportunity buckets at the right time and the right price.

A new fundamental world needs new fundamental ideas.

Footnotes

1Thompson Reuters

2New York University Stern School data

3St. Louis Federal Reserve FRED data

4New York University Stern School data

5World Bank Database

This commentary is provided for informational and educational purposes only and does not consider individual personal, financial, legal, or tax considerations. The information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment or other strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass.

Any opinions or forecasts contained herein are based on information and sources deemed reliable, but we do not warrant the accuracy of the information. You should note that the materials are provided “as is” without expressed or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investing involves risk and the potential to lose principal. Past performance does not guarantee future results.

Bonds involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed-income securities falls. Some risks associated with real estate investing include changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets. Commodity-related products may be extremely volatile illiquid and can be significantly affected by underlying commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions.

This information is not a substitute for specific individualized tax, legal, financial, or investment planning advice. Where specific advice is necessary or appropriate, we recommend that you consult with a qualified professional.

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation. The index is unmanaged and cannot be directly invested in.

Mariner Advisor Network is a brand utilized by Mariner Independent Advisor Network (“MIAN”) and Mariner Platform Solutions (“MPS”). Investment advisory services are offered through Investment Adviser Representatives registered with MIAN or MPS, each an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. MIAN and MPS comply with the current notice filing requirements imposed upon registered investment advisers by those states where they transact business and maintain clients. MIAN and MPS have either filed notice or qualify for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MIAN or MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For information about which firm your advisor is registered with, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided by your advisor.

Investment Adviser Representatives are independent contractors of MPS or MIAN and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS or MIAN and is not registered with the SEC. Please refer to the disclosure statement of MPS or MIAN for additional information.